Background

Recently, it was announced by MikeMirzayanov that NEAR would be contributing to the funding of Codeforces. Clearly, the influx of additional funding was very important to Codeforces. In this blog I want to look at the NEAR cryptocurrency in more detail, and analyze the possibility of a complete collapse.

The Story of Terra Luna

Between May 5 and May 12th, the cryptocurrency Terra Luna lost all of it's value: wiping $45 billion off of the crypto market.

Between May 5 and May 12th, the cryptocurrency Terra Luna lost all of it's value: wiping $45 billion off of the crypto market.

What were the "fundamental design mistakes" (according to the Binance CEO) of Terra Luna? Perhaps simply the entire idea of an algorithmic stable coin.

A "stable coin" is merely a cryptocurrency whose value is supposed to remain fixed, usually relative to the dollar. For example, the stable coin USDC has had a maximum price deviation of only a tenth of a percent from its pegged value of 1 US dollar.

The so-called breakthrough of Terra Luna was a "decentralized" stablecoin that was not tied to a governmental currency. The blockchain was home to two cryptocurrencies: Terra (UST), which was supposed to be a stablecoin fixed at 1 dollar, and Luna (LUNA) which was supposed to be a normal volatile cryptocurrency.

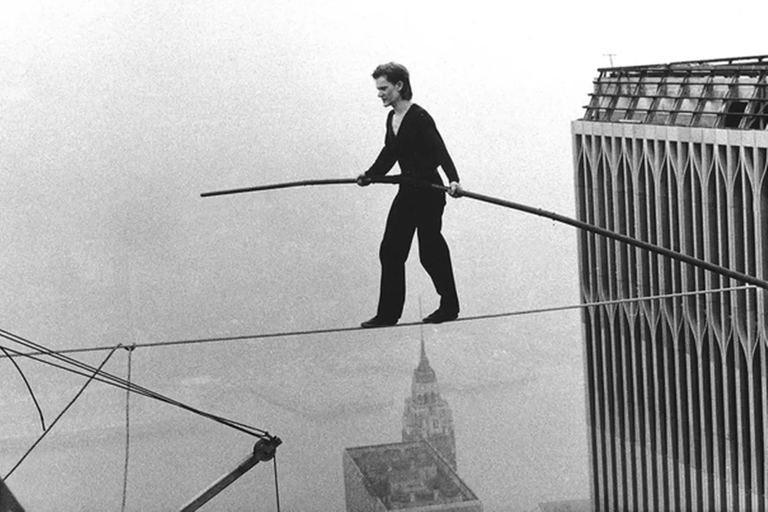

A Crypto Balanced on a Tightrope

A sophisticated algorithm linked Terra with Luna. Luna was used to maintain Terra's stability, and Terra's stability was used to preserve Luna. Anyone could "burn and mint" 1 UST, and receive $1 worth of LUNA in return. The final fallback was $3 billion in Bitcoin reserves.

A sophisticated algorithm linked Terra with Luna. Luna was used to maintain Terra's stability, and Terra's stability was used to preserve Luna. Anyone could "burn and mint" 1 UST, and receive $1 worth of LUNA in return. The final fallback was $3 billion in Bitcoin reserves.

An accurate analogy was that Terra Luna was like a tightrope walker. While the winds were calm the pole would be enough to keep everything balanced.

A Classic Run Ensues

The spark that set off the fire will probably never be known (social media rumors suggested that a massive $1 billion liquidity crunch caused by Citadel was to blame). Anyways, a general downturn in the cryptocurrency market was causing all investors to rethink their crypto portfolios.

As people began to dump their UST holdings, causing massive hyperinflation in LUNA, the peg between the two currencies began to collapse. Attempts were made to save the peg via injecting Bitcoin, but the Terra blockchain simply didn't have enough liquidity to save itself. As it became clear that UST was not going to maintain it's $1 peg (thus making it essentially worthless since it's entire point was to be a "stable" coin), both cryptos collapsed in a death spiral together.

The Tragic Aftermath

Both UST and LUNA lost almost all of their value: tens of billions of dollars were wiped off of the cryptocurrency market in approximately a week. It became obvious that ALL "stable"-coins are vulnerable to total collapse if they lack the liquidity to maintain their peg to the dollar.

The NEAR Protocol

NEAR is a cryptocurrency based off the #2 crypto Ethereum's blockchain. NEAR's main improvement is that it can process transactions much faster than Ethereum can via technical improvements discussed here. This makes it extremely useful for large-scale projects that need to process thousands of monetary transactions per second. Additionally, 15% of NEAR's original employees were ICPC medalists. :O

Potential NEAR Vulnerabilities

NEAR itself is not a stablecoin, so it's not going to face the same hyperinflation that happened to Luna.